If you are looking for a bot to help you trade futures, there are a few options to choose from. These tools will automatically buy and sell futures contracts on your behalf. They can also be customized by you. However, it is important to understand the risks associated with trading with a futures bot. Some of the risks include overtrading and market manipulation. You should choose an exchange that is fair with its trading fees.

There are two basic types of futures trading bots – grid and spot. Grid trading bots allow you to profit from short-term price fluctuations. They are based on support and resistance levels. The Binance Futures tool is a good example of a grid trading bot. This is a powerful strategic tool.

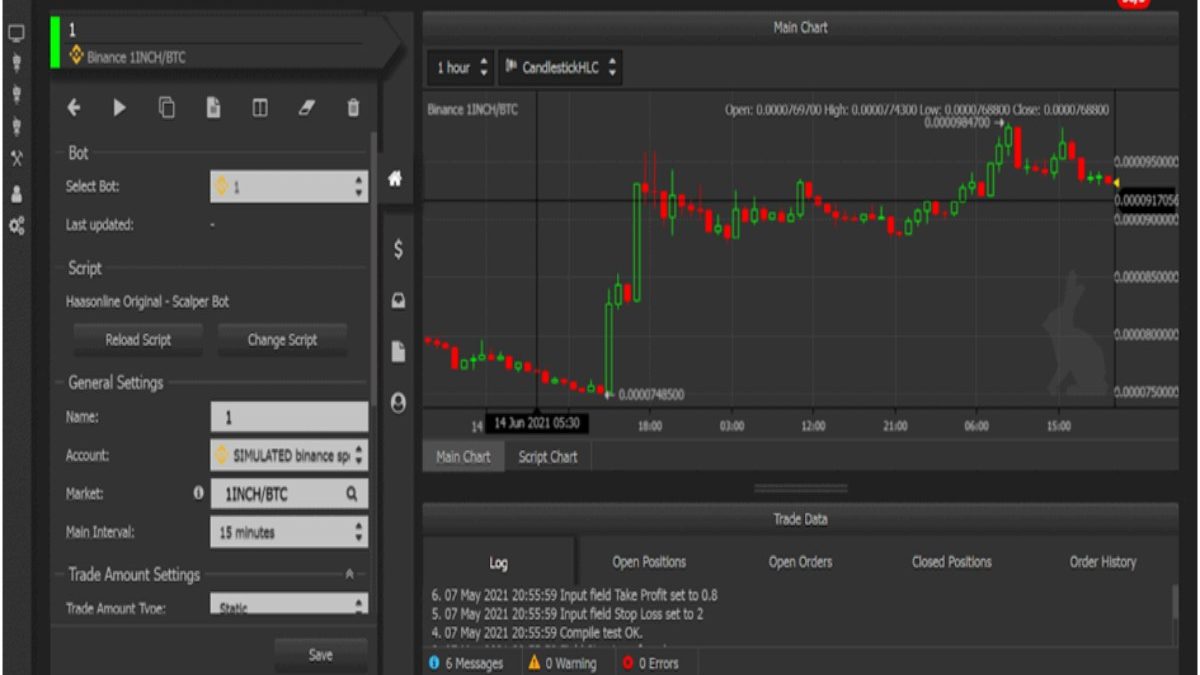

The Binance Futures tool allows you to automate buy and sell orders for futures. You can also set up extra orders to increase your profit margin. The Binance Futures tool is easy to use and offers a lot of features. This tool also helps you to maximize your liquidity by making it possible to easily integrate third-party trading applications.

The Binance futures bot has developed recommended parameters that allow you to choose a grid that is most suitable for you. There are two different grids that are available: the Neutral Grid and the Long Grid. The Neutral Grid is ideal for traders who are focusing on in-range volatility. The Long Grid is excellent for trending markets. Both of them can be used by both beginners and experienced traders.

When you are trading futures with a bot, you should choose an exchange that charges a reasonable fee. For example, Binance charges a relatively low trading fee. The fee is a small portion of your profits. You should also choose an exchange that allows you to use leverage. Many futures bots offer leverage as a means of boosting your returns. A higher leverage means a smaller position, but it also comes with a larger risk.

If you are interested in using a futures bot, then you may want to consider using a bot that is approved by the U.S. FinCEN. Similarly, you should select an exchange that supports IP whitelisting. If your IP is on Binance’s banned list, your account might be suspended or terminated.

The Stoic algorithm uses machine learning intelligence to analyze the correlation between the prices of different assets. The algorithm also analyzes the price volatility and returns. If the price of the coins is likely to fall, then the algorithm will send Trailing Orders that will sell coins at a lower price. The Stoic algorithm can be integrated with other exchanges, such as Bittrex and Kraken. You can also connect the Stoic app to the Binance API.

Lastly, you can try using a free bot. This bot simulates the bot’s trades over the past 60 days. It will help you to identify inaccuracies and test the settings of your bot. To start using the free bot, sign up for an account at Binance. You’ll be asked to fill out a few forms.